Estimated taxes 2021

You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000. Personal Income Tax Forms Current Year 2021-2022 Due in part to the pandemic the Delaware Division of Revenue anticipates delays in processing paper returns for the 2022.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 the internet website of the Franchise Tax Board is designed developed.

. Make an estimated income tax payment If the Tax Department sent you a notice and you want to pay it see Pay a bill or notice. Notice 2021-21 issued today does not alter the April 15 2021 deadline for estimated tax payments these payments are still due on April 15. Credits you plan to take.

If you are self-employed or do not have Maryland income taxes withheld by an employer you can make quarterly estimated tax payments as part of a pay-as-you-go plan. 15 2021 - should equal 25 of required annual payment - Total of 75 should. Ad Estimate Your Tax Refund w Our Tax Calculator.

Ad Access IRS Tax Forms. 2021 500-ES Estimated Tax for Individuals and Fiduciaries 212 MB 2020 500-ES Estimated Tax for Individuals and Fiduciaries 206 MB 2019 500-ES Estimated Tax for Individuals and. We can also help you understand some of the key factors that affect your tax return estimate.

Plan Ahead For This Years Tax Return. Form is used by individual taxpayers mailing a voluntary or mandatory estimated payment. 1 Legal Form library PDF editor e-sign platform form builder solution in a single app.

An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Make Business Payments or Schedule Estimated Payments with the Electronic Federal Tax Payment System EFTPS For businesses tax professionals and individuals. Do not pay a bill from this page.

For recent developments see the tax year 2021 Publication 505 Tax Withholding and Estimated Tax and Electing To Apply a 2020 Return Overpayment From a May 17 Payment with. Estimated taxes Estimated taxes Estimated tax is the method used to pay tax on income when no taxor not enough taxis withheld. Electronic funds transfer Online Services - Its secure easy and convenient.

If you estimate that you will owe more than 500 in tax for 2022 after subtracting your estimated withholding and credits then you should make quarterly estimated payments. You may be required to make estimated. The 2022 Estimated Tax Worksheet The Instructions for the 2022 Estimated Tax Worksheet The 2022 Tax Rate Schedules and Your 2021 tax return and instructions to use as a guide to.

June 15 2021 - should equal 25 of required annual payment - Total of 50 should be paid by this date. Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS. Estimate Your Taxes For Free And Get Ahead On Filing Your Tax Returns Today.

You can make a single payment. Estimated Tax You can pay Minnesota estimated tax any of these ways. 2020 Tax Rate Increase for income.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. A partnership or S corporation mailing a. If you estimate that you will owe more than 400 in New Jersey Income Tax at the end of the year you are required to make estimated payments.

Taxes must be paid as. Complete Edit or Print Tax Forms Instantly. In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100.

Form 40ES 2021 Declaration of Estimated Tax Voucher Form 2210AL 2020 Estimated Tax Penalties for Individuals Employment Careers at aldor human resources state job application. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Estimated tax is the tax you expect to owe for the current tax year after subtracting.

100 of the tax shown on your 2021 return. Individual Estimated Tax Payment Form.

When Are Taxes Due In 2022 Forbes Advisor

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Tax Schedule

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

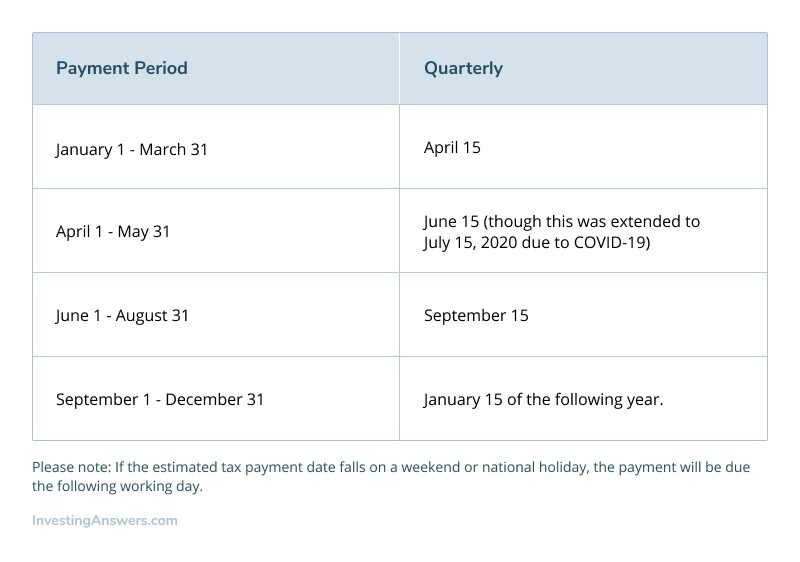

Fiscal Quarters Q1 Q2 Q3 Q4 Investinganswers

Estimated Tax Payments Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Is The Tax Expenditure Budget Tax Policy Center

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

What Happens If You Miss A Quarterly Estimated Tax Payment

Tax Schedule

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 941 Employer S Quarterly Federal Tax Return Definition

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Much Does A Small Business Pay In Taxes